ROADNIGHT MUSING – SEPTEMBER 2024

GENERATING INCOME IN INVESTMENT PORTFOLIOS

OPTIONS FOR ADDING INCOME TO AN INVESTMENT PORTFOLIO

An investment portfolio should be designed to meet the investor’s income and capital growth needs, which change over time. A portfolio that starts primarily focused on capital growth will usually shift to being more income-focused as the investor ages. One advantage of this shift is that the volatility and risk associated with the portfolio reduce as the portfolio diversifies away from the high growth but more volatile listed equities.

There are many ways investors can generate income from investment portfolios. Traditionally, income generating assets were limited to government and investment grade corporate bonds. However, investors can now access a much broader array of income generating options, including non-investment grade corporate bonds, bank hybrids, structured finance (i.e. residential mortgage-backed and asset-backed securities), syndicated bank loans, and, of course, private debt (including lending to corporate businesses, agriculture, and or property developers).

Roadnight Capital’s investment process focuses on generating great risk-adjusted returns for its investors. We measure our success by assessing whether our investments generate a premium over what investors can access in public markets. To do this, we constantly assess the relative value of income generating assets across both listed and private credit markets. As shown in Chart 1 below, we believe the Roadnight Capital Diversified Income Fund, after fees and provisions, achieves this objective relative to the other options.

CHART 1 - NOT ALL CREDIT/FIXED INCOME IS CREATED EQUAL!

Source – Roadnight Capital. Current yield to maturity across various income markets.

ASSESSING THE PRIMARY INCOME-BASED INVESTMENTS AVAILABLE IN AUSTRALIA

Bank Hybrids – The cornerstone of many Australian portfolios

Bank hybrids have traditionally been a key means by which retail investors get exposure to income generating assets. While bank hybrids come in many forms, they have the following features:

A step up in income generation from 10 yr government bonds of 250+ bps

Some equity type characteristics, such as convertibility into equity of the underlying bank or deep subordination.

Advantages:

High yields- Bank hybrids have historically priced in a range of 250-to-450bps over BBSW (equivalent to 6.8% to 8.8% based on current interest rates).

Floating rate- Have floating interest rates, which benefit if interest rates rise.

Many hybrids are fully franked- which are particularly attractive to SMSF and charitable institutions.

Listed on the ASX- Both retail and wholesale investors can easily access small parcels with reasonable liquidity.

Are issued by good quality counterparties - Australian banks remain some of the best credit risk rated in the world, being governed by a strong and supportive regulatory regime.

Disadvantages:

They are deeply subordinated and treated as equity in a bank’s capital adequacy ratios.

Hybrids contain a huge amount of optionality for the bank. Coupons/income and timing of capital re payment are at the discretion of the bank.

Australian banks have been able to leverage off their brand name into retail investors, who may struggle to fully understand the structure and equity characteristics of hybrids. This was a key determinant in APRA’s reasoning to phase out Tier 1 bank hybrids.

Interestingly, despite being a staple of many Australian investment portfolios, APRA recently announced that it intends to phase out the issue of bank hybrid securities (with the transition starting on Jan 1, 2027, and all bank hybrids being phased out by 2032). Banks will be required to replace Tier 1 hybrids with a combination of equity and Tier 2 subordinated bonds. As a result, the $43bil Australian bank hybrid market, which has been strongly supported by retail investors will now need to find an income replacement.

SO WHAT ARE THE ALTERNATIVES TO BANK HYBRIDS?

Bank hybrids in the Australian context are like a giant gum tree that has potentially been shading out other trees from growing. So while some investors may still have limited exposure to income generating assets outside of bank hybrids, when you look there are a wide range of options available many of which produce much better risk adjusted returns.

1/- Structured Finance (RMBS/ABS)

Wholesale investors have increasingly been able to access securitised markets to broaden their fixed income exposure, particularly as the non-bank financial institutions rely on securitisation as the primary funding source without the benefit of bank deposits.

The breadth of the securitisation market in Australia is still relatively narrow, with residential mortgages accounting for about 75% of issuance, and asset backed securities (primarily auto and consumer loans) making up the rest. The size of the RMBS market has gradually expanded, and now accounts for about 5-10% of funding for all residential mortgages in Australia and expected to continue growing.

We may also see the rise of alternative structured finance, which involves the use of securitisation-like structures for investing in pools of agricultural assets, commercial property, and various forms of royalties and insurance obligations.

CHART 2 - SECURITISATION ISSUANCE IN AUSTRALIA

Source- Australian Securitisation Forum

Advantages:

Strong structural investor protection mechanisms, with strict criteria around what can and cannot go into securitisation pools.

A pricing premium to corporate bond markets, with ‘BBB’ rated prime RMBS trading in a range of BBSW plus 250-to-450bps (approx. 6.8%-to-8.8%) through the cycle.

While the market is over the counter, the enormous size of the RMBS market and substantial investor pool provides liquidity in a normal market.

The structured markets are underpinned by external credit ratings.

Disadvantages:

Investments are highly structured and complex requiring specialist expertise to analyse and invest, particularly as you move into higher risk areas of the market.

The underlying asset class is still heavily concentrated in residential mortgages and not dis-similar to investing in banks, with residential mortgages typically making up around 50% of major bank balance sheets and 65% of regional banks.

2/- Syndicated Bank Loans

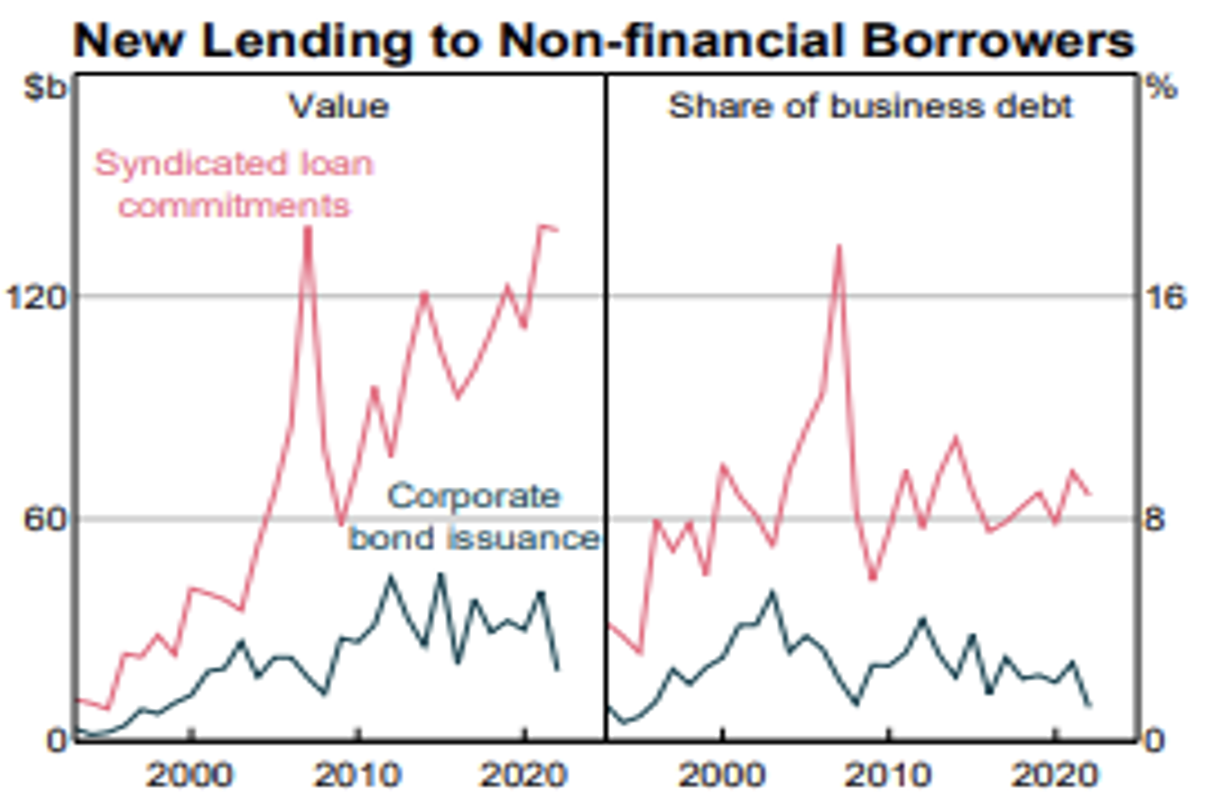

The syndicated bank loan market in Australia is dominated by infrastructure, utilities, real estate issuers, and accounts for about 10% of the stock of total business debt in Australia. It is large, at more than two times size of the corporate bond market in Australia and has at least doubled in size over the past 10 years.

CHART 3 – GROWTH IN THE AUSTRALIAN SYNDICATED BANK LOAN MARKET

Source- Australian Securitisation Forum

Advantages:

Large, deep market, with average facility size of about $300mil. A large pool of offshore institutional investors participates in the syndicated loan market.

Low issuance cost and flexible loan terms for borrowers.

Access to company information, with lenders typically treated as insiders compared with public markets.

Borrowing facilities can be fully drawn on day one which can be attractive to wholesale investors, rather than revolving working capital type facilities that may be better suited to banks.

Disadvantages:

Given the size of the syndicated loan market, pricing reflects the competitive nature often pricing in the range of BBSW plus 150-to-250bps (5.8%-6.8%).

Lack of control. Workouts and managing covenant breaches can be problematic, particularly if the syndicate of banks is large and disjointed.

Liquidity can be patchy, with banks being buy and hold investors.

PRIVATE DEBT

Private debt means different things to different people. We think of private debt as a loan to a business by a non-bank lender, institution, or private investor. Borrowers in the private debt markets are typically small to mid-sized companies that need funding for general working capital, M&A, or capital investment. They can encompass private family-owned, private equity, or publicly listed companies. However, most of these borrowers are private companies that are unable to access the public debt markets. Large users of the private debt market include property and development companies, agricultural enterprises, the manufacturing and service-based sectors, and non-bank finance companies themselves.

Private debt is not issued or traded on public markets and is made on a bilateral basis between a lender and borrower. The private debt market is estimated to be over $150bil in Australia and has dramatically grown in the past decade as Australian banks have looked to rationalise their lending operations.

As demonstrated by the performance of the Roadnight Capital Diversified Income Fund, returns can be higher than those available in corporate bonds, bank loans, and structured crdit markets. Importantly, we believe private debt markets offer superior risk-adjusted returns and more than compensate investors for the illiquidity of the underlying investments.

Advantages:

Higher yields are available compared with the corporate bond, syndicated bank loan and structured finance markets.

Bilaterally negotiated lending facilities enable the lender to remain in control throughout the life of the investment, particularly should the lender need to step in and recover capital prior to maturity.

Facilities tend to be heavily secured, with a first ranking claim over the assets, business, and often include personal director guarantees.

Disadvantages:

The bi-lateral nature of the facilities means they are illiquid, buy and hold, and held at book value by the lender given limited valuation reference points.

Private debt often provides a shorter-term capital solution for the borrower given the higher cost of capital (not bank deposit funded).

Loans are lumpy in nature, and require specialist skills and sizable team to originate, structure, and manage the loans through to maturity.

If you would like more information about the Fund, please click on this link or email us at: investors@roadnightcapital.com