CO-INVESTMENT OPPORTUNITIES

CO-INVESTMENT OPPORTUNITIES – ANGLER FUND

Roadnight Capital offers its investors and partnership channels the ability to participate directly in selected private debt and alternative asset opportunities through the Angler Fund Series. The co-investment opportunities usually provide a running fixed yield, have a term of 1-to-3 years, and can range from lower risk secured debt through to hybrids with some inbuilt capital/equity upside potential.

If you are a wholesale investor and would have interest in investing in Co-Investment Opportunities, please click on the below link and fill out the form. We will be in contact with you shortly.

CURRENT OPPORTUNITIES AND PAST INVESTMENTS…

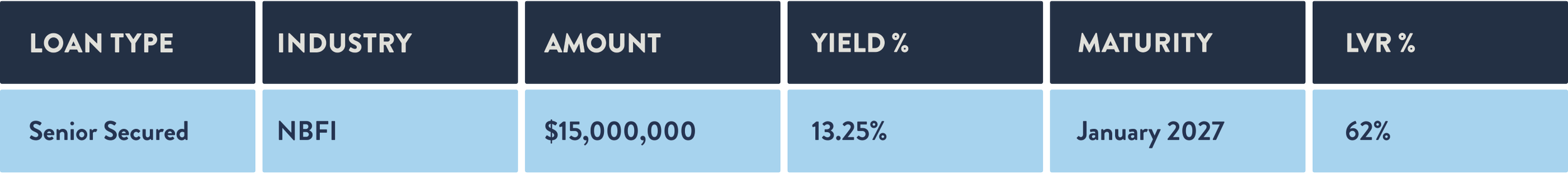

PROJECT: GREEN

Angler – Fund No.14

A consumer finance specialist, providing short and medium-term consumer loans to borrowers who fall outside of the traditional bank criteria. The senior secured loan is supported by a receivables portfolio on a LVR of 60%, combined with a profitable business which is underpinned by a strong market position and automated credit assessment technology.

PROJECT: GREEN TERMS

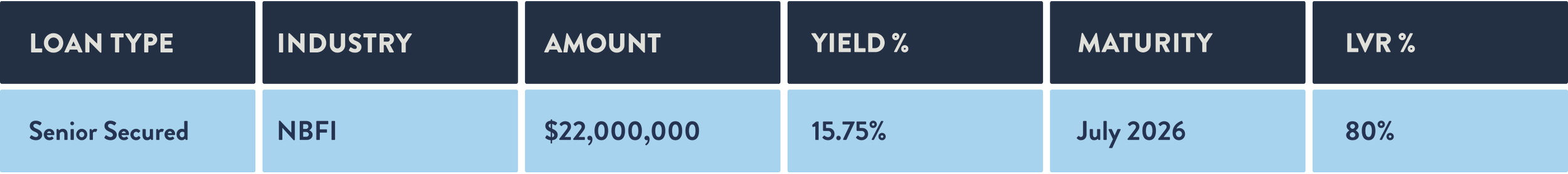

PROJECT: HOLIDAY

Angler – Fund No.13

Corporate facility to a specialist travel provider that offers lay-by payment plans for travel, allowing customers to lock in prices of airline tickets and pay them off in instalments. The loan is supported by a high-quality receivables portfolio on an LVR of 80%, with minimal arrears and the underlying airline tickets held by the lender until full payment of the loan.

PROJECT: HOLIDAY TERMS

PROJECT: ABC

Angler – Fund No.11

A non-bank finance company specialising in asset-backed lending to small-to-medium enterprises in Australia focused on providing revolving lines of credit and commercial loans secured against business receivables, inventory, P&E, or property. The secured loan portfolio with a first registered mortgage over businesses is diversified by issuer and industry and generally lends 60% against business assets.

The group's loan facility is supported by substantial equity in the business (LVR of 65%) and a profitable business that provides comfort on debt serviceability.

PROJECT: ABC TERMS

PROJECT: EMBEDDED

Angler – Fund No.9

An ASX-listed energy service provider with embedded network customers across strata communities. The business predominately services the Queensland strata communities, selling them electricity, hot water, solar and battery systems.

The loan facility benefits from senior security over the entire group and has a conservative 16% LVR against the value of its embedded networks and customer utility contracts, locked in hedge payment receivables and other investments.

PROJECT: EMBEDDED TERMS

PROJECT: TECH FIN

Angler – Fund No.8

Innovative financier of software, hardware, and professional services for Australian businesses, allowing its customers to spread the upfront costs of critical technology as the underlying benefits from the investment are realised. Technology funded is provided by top-tier technology providers such as Salesforce and Cisco, with the founders having previously built technology finance operations for the likes of Microsoft and Cannon.

The loan facility has a senior security over all business assets, with an LVR of less than 80% against the value of the receivables portfolio.

PROJECT: TECH FIN TERMS

PROJECT: ROBIN

Angler – Fund No.7

A subscription-based technology platform that provides corporate credit cards and expense management for small and medium-sized businesses. The platform helps manage staff expenses and integrates with leading accounting and expense management software, removing manual data entry. The company has built up a diverse portfolio of clients from across the health, wholesale trade, technology, retail, and building sectors and has white-labelled its offering to an ASX 50 listed company.

The loan facility has a senior security over all business assets, with a maximum 80% LVR against its diverse book of receivables.

PROJECT: ROBIN TERMS

PROJECT: RFP

Angler – Fund No.6

A mixed agricultural enterprise in the central west catchment area of NSW, with a combined landholding of 3,200 hectares of irrigated land, dryland cropping, and mixed grazing. Badly impacted by drought, the borrower has required a capital solution for working capital to plant crops, as well as drought proofing the property through construction of dams and acquisition of pivots, to improve and reduce volatility in cashflows.

The loan facility has been structured with a 32.8% LVR, backed by a first registered mortgage against real property and water rights, to provide substantial protection against further short-term weather and commodity price events.

PROJECT: RFP TERMS

PROJECT: APPLE

Angler – Fund No.5

A leading Australian technology and manufacturing company operating in the Defence, Communications, and Space markets. The company’s products incorporate advanced electro-optic applications, laser, electronics, optronics, telescopes, and precision mechanisms. The loan is being used to bridge a working capital gap due to the impact of Covid-19 supply chains.

The A$35mil facility is fully backed by $570mil contracted revenues, $180mil inventories, and $50mil in cash and working capital.

PROJECT: APPLE TERMS

DISCLAIMER

Roadnight Capital Pty Ltd ACN 162 318 729 AFSL Authorised Representative No 001304639 is the fund manager of the Roadnight Diversified Income Fund (Fund). Melbourne Securities Corporation Limited ACN 160 326 545 AFSL 428289 (Trustee) is the trustee of the Fund. The Fund is only available to investors who are Wholesale Clients, and are not Retail Clients, all within the meaning of the Corporations Act 2001. Roadnight Capital Pty Ltd is an authorised representative of Roadnight Financial Services Pty Ltd ACN 661 932 958 AFSL 548038. Roadnight Capital Pty Ltd is authorised to provide general financial product advice and to deal in interests in Australian managed investment schemes. This website contains general information only and does not take into account any person’s objectives, financial situation or needs and accordingly does not constitute personal advice for the purposes of section 766B(3) of the Corporations Act 2001.

The general information on this website does not constitute an offer to invest in the Fund and should not be used as the basis for making an investment in the Fund. Before making an investment in the Fund, you should consider important information about risks, costs and fees in the relevant disclosure document available by contacting Roadnight Capital Pty Ltd. The Information Memorandum for the relevant Fund is available by contacting Roadnight Capital Investor Team via investors@roadnightcapital.com.au. Any investment is subject to risk, including possible loss of income or capital invested. None of Roadnight Capital Pty Ltd, the Trustee or any of their officers, advisers, agents or associates guarantees in any way the performance of the Fund. Past performance is not an indicator of future returns. The content of this website is current at the time of publication and may be amended or revoked by Roadnight Capital Pty Ltd at any time.